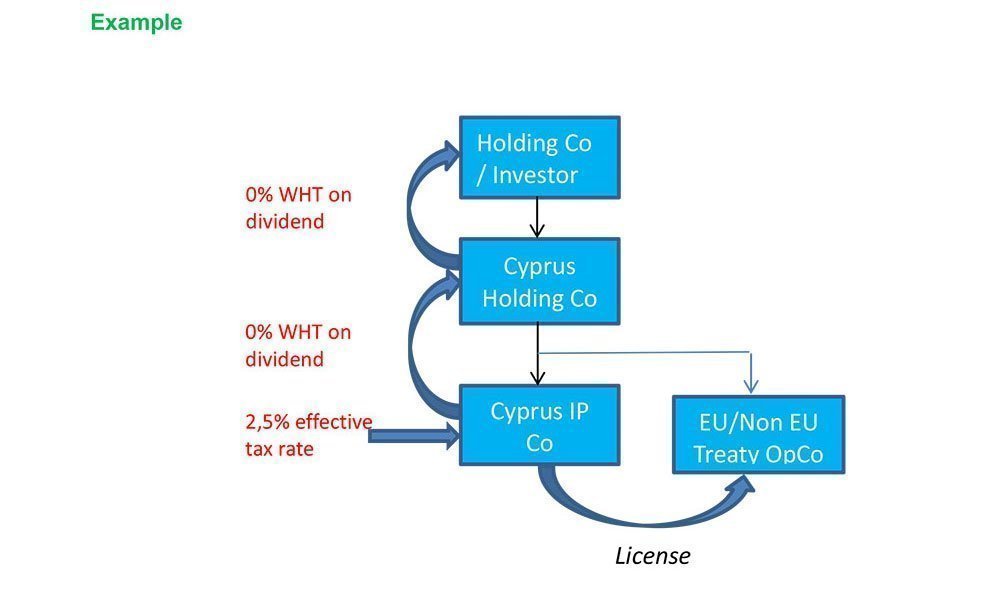

The Cyprus Income Tax Law has been recently amended to allow for an 80% exemption on the net income generated from the utilization of patent, trademark or any other intellectual property (IP) rights. Net income in this case is defined as income from IP minus all expenses attributable to the specific income. This exemption results in an effective tax rate of 2,5% from the utilization of Cyprus registered IP (since corporate tax rate is set at 12,5%). The same exemption applies in cases of any gain arising from the disposal of such IPs. In addition, the rate of capital allowances on such intangibles has been set at 20% of the cost of acquisition.

It is worth noting that the definition of patent right and intellectual property rights has been amended to correspond to the meaning of the local Patent Rights Law of 1998, the Intellectual Property Law of 1976 and the Law regarding Trademarks. This development ensures that uncertainty is lifted in regards to which types of IP rights are covered.

As a result, Cyprus is now the most attractive tax wise EU onshore jurisdiction for IP registrations and IP holders and developers can now avoid registering their IPs in targeted offshore jurisdictions and tax heavens.

The amendment has retrospective effect since 1 January 2012.